SASSA Easy Pay Green Card [Application]

People face challenges, including the risk of receiving grant funds in cash, increasing the chance of theft. That’s where SASSA’s easy pay green card helps.

You have no access to traditional banking services, which limits your capacity to save and safely handle your money.

Easy Pay SASSA green card has a solution to your problem. Here is how to apply? eligibility criteria, its working, benefits, how it differs from the SASSA card, and everything you need to know about.

What is SASSA’s Easy Pay Green Card?

The SASSA Easypay Green Card is a prepaid debit card created to offer recipients of social grants in South Africa a safe and practical means to receive their monthly payments.

In collaboration with Grindrod Bank, the South African Social Security Agency (SASSA) issued this card.

Like a debit card, it works at participating shops and ATMs to let cardholders make purchases, withdraw cash, and complete other transactions.

Even though SASSA applicants often mistake the EasyPay Green Card for the SASSA, it is essential to clarify that this is untrue.

Importance of Easy Pay Green Card

It offers enhanced financial security, convenience, and access to banking services for individuals who may have been excluded from traditional economic systems.

This card encourages responsible spending through discounts and savings and supports the transition to digital payments.

Eligibility Criteria for SASSA Easy Pay Card

South African Residency

Only nationals or legal permanent residents of South Africa are eligible for the SASSA Easypay Green Card. When requesting the card, applicants must present proof of citizenship or residency.

Without a bank account

The SASSA Easypay Green Card is meant for people without bank accounts. A bank account will disqualify a beneficiary from receiving the card.

Age Requirement

Must be 60 years and over or must be disabled.

Financial Means Testing

The eligibility for some awards, including the Child Support Grant, may be based on financial circumstances. The means test analyses the applicant’s and their household’s financial position to determine eligibility for the grant.

Have a valid ID book

A valid South African ID book is required for SASSA Easypay Green Card program applicants. The ID book needs to be accurate and in good condition.

Specific Health Conditions

Proof of a qualifying medical condition may be required for some grants, including the disability grant. Medical evaluations and records may be requested as part of the eligibility procedure.

Required Documents

South African ID Document

A valid South African Identity Document (ID) or smart card ID is typically required to establish your identity.

Proof of Residence

Some applications may require documents proving your residence, such as a utility bill, rental agreement, or a letter from the local municipality.

Proof of Income

If your grant application involves testing, you may be required to provide proof of your income.

Medical Records (if applicable)

For specific grants, like Disability Grants, you may need to provide medical records.

Marriage Certificate or Child’s Birth Certificate (if applicable)

In the case of grants related to marriage or child support, you may need to provide relevant certificates or documents.

Bank Account Information

If you already have a bank account, please provide your bank account details for depositing grant funds.

Recent Photograph

Sometimes, you may need to provide a recent passport-sized photograph for your application.

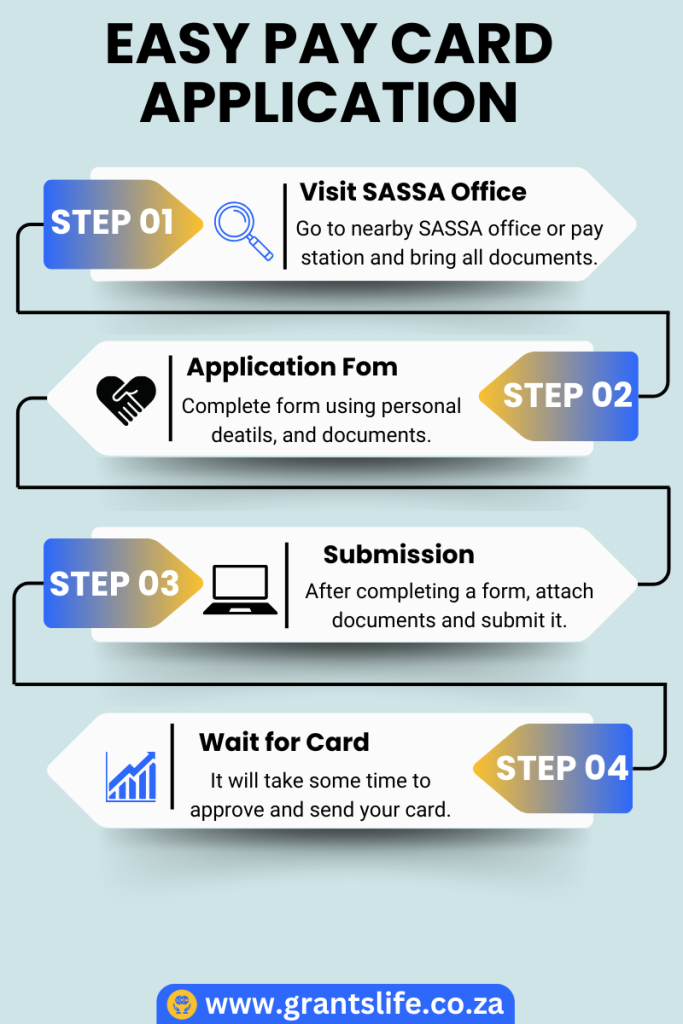

Easy Pay Green Card Application

Visit a SASSA office or pay point.

Beneficiaries can apply for the SASSA Easypay Green Card at an SASSA office or pay station. To finish the application process, they must bring the necessary paperwork.

Complete the application form.

Once at the SASSA office or pay point, beneficiaries will be given an application form to complete. They will need to provide their personal information, such as their name, address, contact details, and the required documents.

Submit the application form and documents.

After completing the application form, beneficiaries must submit all required documents to the SASSA officer.

Wait for the card to be issued.

If the application is approved, the SASSA official will issue the beneficiary with the SASSA Easypay Green Card. It may take a few weeks.

Activate the card

The beneficiary must activate the card after it is issued by following the instructions provided on the card. Typically, registering the card and creating a PIN involves calling a phone number or going online.

Other Possible Methods of Applying

Bank Application

As partners in the EasyPay Green Card program, some banks may offer an application process within their branches.

Assistance from Local Authorities

In some cases, local government offices or municipalities may assist individuals with the application process for the SASSA Green Card.

Difference between the SASSA card and Easy Pay Card

Unlike users of SASSA grants, who receive funds to cover their living expenses instead of paying the loans later, EasyPay Green Card is a loan application only open to people who can afford to repay the loans.

A loan service called Easypay Green Card is connected to the loan firm MoneyLine agency. However, the South African Social Security Agency, or SASSA, distributes the grants to needy people.

SASSA is mainly for those not earning anything and needing financial assistance. In contrast, EasyPay Green Cards are issued to those who can repay the loan later. Hence, SASSA and Easy Pay are pretty different.

Advantages of Easy Pay SASSA Green Card

Numerous advantages are provided by the SASSA EasyPay Green Card, including improved security, simplicity, and financial inclusion.

Since the recipients of the SASSA Easypay Green Card are not required to have a bank account, it also serves to be broader.

It also means that people can still receive their social grant payments even if they do not have access to typical banking systems.

Overall, the SASSA Easypay Green Card is an innovative financial inclusion tool that offers a secure and convenient way for social grant beneficiaries to access their funds.

Are SASSA grants associated with easy pay?

There is a misunderstanding that the EasyPay Green card is associated with SASSA grants. But there is no relation between them.

The Easy Pay Green card is a debit card that users can use to buy things and pay their bills. Also, they can lend money from EasyPay.

Conclusion

In South Africa, the SASSA Easy Pay Green Card has grown into an effective instrument for financial inclusion. By offering safe, practical, and open access to social grants, It has improved the lives of millions of vulnerable citizens.

So we have enlisted a green card, how it works, its benefits, and all the methods to apply for it, so now you don’t have to worry about managing your expenses.